E Invoice for Delivery Challan: Rules, Format & Compliance

An e invoice for delivery challan is required when goods move for business purposes other than immediate sales. These movements include stock transfers, job work, demonstrations, replacements, or returns. Instead of relying on paper documents, the transaction is validated electronically through an official portal, creating a legally verifiable record that enforcement officers can check instantly.

Traditional delivery challans only confirm dispatch details. They do not provide centralized verification. By contrast, an e invoice for delivery challan is authenticated through digital registration, which reduces fraud, duplicate entries, and unreported transportation. This system also improves transparency between suppliers, transporters, and tax authorities.

According to industry practices in electronic compliance, digital invoicing improves tracking accuracy and shortens audit cycles. Businesses using automated reporting experience fewer disputes and faster inspections.

An e invoice for delivery challan is a digitally registered document generated through a government-authorized portal when goods are transported without a sale. It assigns an Invoice Reference Number (IRN) and QR code to validate the challan, ensuring legal movement, tax compliance, and real-time reporting to authorities.

Key Facts at a Glance

- Used when goods move without sale

- Mandatory for eligible registered taxpayers

- Generated through Invoice Registration Portal (IRP)

- IRN and QR code required

- Linked with E Way Bill

- Prevents fake or duplicate challans

- Improves audit readiness

- Reduces penalties and shipment delays

Why Businesses Need an E Invoice for Delivery Challan

Goods transported without valid documentation may be detained or penalized. An e invoice for delivery challan provides legal proof that the movement is legitimate and properly reported to the tax system. It protects businesses from compliance risks during roadside inspections and warehouse audits.

Many organizations operate multiple warehouses, vendors, and subcontractors. In such environments, tracking goods manually becomes unreliable. A standardized e invoice for delivery challan ensures every dispatch is recorded digitally with timestamps, reference numbers, and verification codes. This creates an audit trail that simplifies reconciliation.

The system also reduces operational inefficiencies. Staff no longer need to prepare multiple paper forms. Digital validation automatically shares data with transport systems and compliance portals. Based on compliance statistics from digital tax regimes, automated documentation reduces manual errors significantly.

Delivery Challan vs Tax Invoice vs E Invoice

Understanding the differences helps businesses choose the correct document and avoid penalties. A delivery challan is not a substitute for a registered electronic document.

| Feature | Delivery Challan | Tax Invoice | E Invoice for Delivery Challan |

|---|---|---|---|

| Purpose | Goods movement | Sale transaction | Digitally validated movement |

| Tax charged | No | Yes | No |

| Portal registration | Not required | Sometimes | Mandatory |

| IRN/QR code | No | Required (eligible cases) | Required |

| Audit visibility | Low | Medium | High |

| Legal strength | Limited | High | Very high |

A simple paper challan may be rejected during checks. An e invoice for delivery challan provides immediate digital verification through QR scanning.

When Is an E Invoice Required?

Certain operational scenarios legally require electronic reporting. In these cases, generating an e invoice for delivery challan becomes necessary before transporting goods.

Job Work

Raw materials sent to third-party processors must be documented digitally to maintain ownership tracking. An e invoice for delivery challan ensures that goods sent out and returned are properly reconciled.

Stock or Branch Transfers

Movement between warehouses or branches is not a sale but still requires compliance. Authorities expect a registered e invoice for delivery challan for interstate or high-value transfers.

Sales Returns

Returned goods must reference original dispatch records. Electronic validation simplifies matching and prevents disputes.

Exhibitions or Demonstrations

Goods sent temporarily for display, marketing, or testing still require documentation. A compliant e invoice for delivery challan confirms temporary movement.

Warranty or Replacement Goods

Free replacements without billing must still be reported digitally to avoid misclassification as undeclared sales.

Failure to generate the correct document can lead to detention, penalties, or tax notices.

Legal Framework and Compliance Requirements

Electronic documentation is governed by structured reporting rules issued by tax authorities. An e invoice for delivery challan must follow these standards to remain valid.

Core Compliance Rules

- Registered taxpayer identification

- Document uploaded before dispatch

- IRN generation through portal

- QR code printed on copy

- Accurate item classification

- Transport details included

Applicability Overview

| Criteria | Requirement |

|---|---|

| Turnover above threshold | Mandatory |

| Interstate transport | Mandatory |

| B2B movement | Mandatory |

| High-value consignments | Mandatory |

According to regulatory guidelines, transporting goods without a valid e invoice for delivery challan may result in fines, confiscation, or blocked shipments.

Also you can read Islamabad number e challan check to learn how vehicle owners in the capital can quickly verify traffic violations online using their vehicle registration number. The official system allows users to view fines, check violation details, and pay challans online without visiting traffic police offices, making the process simple and convenient.

Mandatory Fields in an E Invoice Delivery Challan

Digital portals validate documents using structured fields. Missing or incorrect entries cause rejection. Every e invoice for delivery challan must include standardized data.

| Field | Purpose |

|---|---|

| Supplier details | Legal identity |

| Consignee details | Delivery address |

| Challan number | Unique reference |

| Date & time | Timestamp |

| Item description | Product details |

| HSN/SAC code | Classification |

| Quantity | Units transported |

| Value | Estimated amount |

| Transporter/vehicle | Logistics info |

| IRN | System-generated ID |

| QR code | Verification |

Standardization allows authorities to validate documents instantly during inspections.

How the E Invoicing System Works

The process relies on real-time validation rather than manual approval. A typical e invoice for delivery challan follows a structured digital flow.

Process Steps

- Create challan in ERP or accounting software

- Convert data into portal format

- Upload to Invoice Registration Portal

- System validates details

- IRN generated automatically

- QR code assigned

- Signed document returned

- Print and attach to goods

Because the e invoice for delivery challan is verified centrally, enforcement officers can confirm authenticity within seconds.

Benefits for Businesses

Digital documentation offers operational, financial, and regulatory advantages. Implementing an e invoice for delivery challan reduces both compliance risk and administrative burden.

Operational Benefits

- Faster checkpoint clearance

- Reduced paperwork

- Automated reporting

- Centralized records

Compliance Benefits

- Accurate audit trails

- Fraud prevention

- Real-time monitoring

- Fewer disputes

Financial Benefits

- Lower penalty risk

- Reduced manual costs

- Faster reconciliation

Organizations using electronic systems report smoother logistics and fewer inspection delays.

Practical Example

A manufacturer sends finished goods to another branch warehouse. No sale occurs. Instead of issuing a tax invoice, the company generates an e invoice for delivery challan, uploads it to the portal, receives IRN and QR code, and prints the document. During transit, officers scan the code and instantly verify legality, allowing the shipment to proceed without delay.

Common Compliance Risks to Avoid

| Risk | Impact |

|---|---|

| Missing IRN | Invalid document |

| Wrong HSN code | Tax mismatch |

| Duplicate number | Portal rejection |

| Manual challan only | Penalty risk |

| Incorrect vehicle details | Transit delay |

Using a validated e invoice for delivery challan minimizes these risks.

Summary

Definition: Digitally registered challan for goods movement without sale

When required: Transfers, job work, returns, demos, replacements

Mandatory elements: IRN, QR code, portal validation

Main benefit: Legal protection and audit trail

Risk of non-compliance: Fines, detention, tax notices

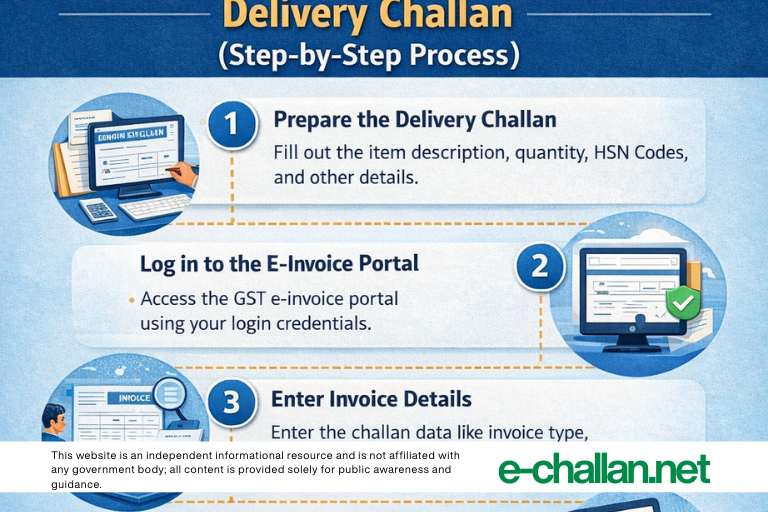

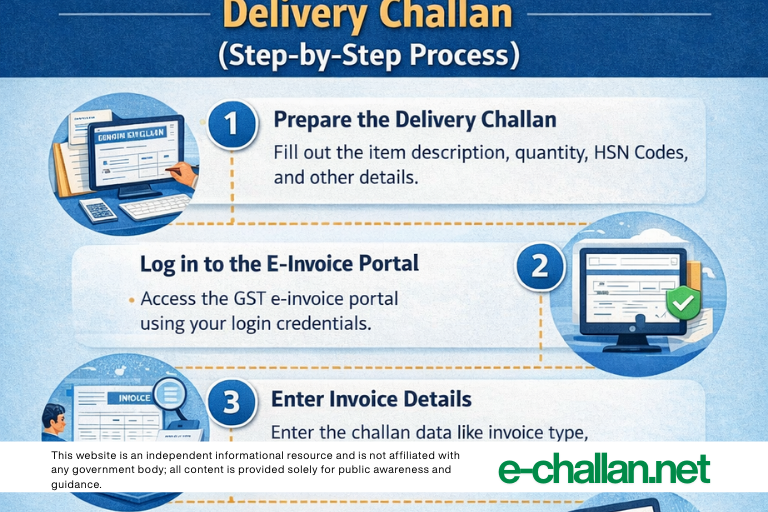

How to Generate an E Invoice for Delivery Challan (Step-by-Step Process)

Generating an e invoice for delivery challan requires digital registration before goods leave the premises. The process ensures that each document receives a unique Invoice Reference Number and government validation. Most portals reject post-dispatch uploads, so pre-generation is mandatory for compliance.

Follow this standardized workflow used across tax systems and ERP integrations.

Step 1 – Create the Challan in ERP or Accounting Software

Enter supplier details, consignee information, product descriptions, quantities, and estimated value. The system prepares the base document for the e invoice for delivery challan.

Step 2 – Select “Delivery Challan” Document Type

Choose the correct transaction reason such as job work, stock transfer, or exhibition. Selecting the wrong type may lead to compliance mismatch.

Step 3 – Convert Data to JSON/Portal Format

The system structures data into the prescribed schema required for portal submission.

Step 4 – Upload to Invoice Registration Portal (IRP)

Upload manually or through API integration. The portal validates fields, tax ID, and document number.

Step 5 – Receive IRN and QR Code

Once approved, the e invoice for delivery challan is assigned:

- IRN (unique number)

- Digitally signed file

- QR code

Step 6 – Print and Attach

Carry a printed or digital copy with goods during transport.

This method ensures the e invoice for delivery challan is legally verifiable at checkpoints.

Manual vs ERP vs Portal Generation Methods

Businesses can create documents using different tools. The correct method depends on transaction volume and automation needs.

| Method | Best For | Advantages | Limitations |

|---|---|---|---|

| Manual portal entry | Small businesses | Simple setup | Time-consuming |

| Excel/JSON upload | Medium volume | Faster bulk upload | Requires formatting |

| ERP integration (Tally/SAP/Zoho) | High volume | Fully automated | Initial setup cost |

| API automation | Large enterprises | Real-time sync | Technical expertise needed |

For frequent dispatches, ERP-based e invoice for delivery challan generation significantly reduces manual work and errors.

Sample Format of an E Invoice Delivery Challan

Below is a practical structure businesses typically follow when preparing an e invoice for delivery challan.

| Section | Example Content |

|---|---|

| Supplier | ABC Manufacturing Pvt Ltd |

| Tax ID | 123456789 |

| Challan No | DC-2026-001 |

| Date | 05-02-2026 |

| Consignee | XYZ Processing Unit |

| Reason | Job Work |

| Item | Steel Components |

| HSN | 7208 |

| Quantity | 500 Units |

| Value | 250,000 |

| Transporter | Local Logistics |

| Vehicle | ABC-123 |

| IRN | Auto generated |

| QR Code | System generated |

Every e invoice for delivery challan must follow structured formatting to ensure portal acceptance and audit clarity.

Compliance Checklist for Businesses

Before dispatch, verify each requirement. A missing field may invalidate the e invoice for delivery challan.

| Checkpoint | Status |

|---|---|

| Tax ID active | □ |

| Challan number unique | □ |

| Correct document type selected | □ |

| HSN/SAC codes accurate | □ |

| Quantity & value entered | □ |

| Transporter details added | □ |

| IRN generated | □ |

| QR code printed | □ |

| E Way Bill linked (if required) | □ |

Using this checklist minimizes errors and ensures the e invoice for delivery challan remains legally enforceable.

Common Mistakes to Avoid

Compliance failures usually occur due to small errors. The following issues frequently cause rejection or penalties.

- Generating challan after dispatch

- Duplicate document numbers

- Wrong HSN classification

- Incorrect vehicle number

- Missing transporter ID

- Using paper challan only

- Not linking E Way Bill

- Forgetting to cancel unused documents

Each mistake can invalidate the e invoice for delivery challan and lead to detention or fines. Preventive verification is recommended before goods leave the warehouse.

Software and Tools That Support E Invoicing

Modern accounting platforms offer built-in modules for creating an e invoice for delivery challan. These tools automate calculations, reduce manual input, and connect directly to government portals.

Commonly Used Solutions

- Tally Prime

- SAP ERP

- Zoho Books

- QuickBooks

- Oracle NetSuite

- Government IRP portal

These systems generate IRN automatically, store digital copies, and synchronize with inventory records. Businesses handling daily shipments benefit from integrated e invoice for delivery challan workflows.

Real-World Use Cases

Understanding practical applications clarifies why digital compliance matters.

Inter-Branch Transfer

A retailer moves stock from Karachi to Lahore. The e invoice for delivery challan documents movement without sale and prevents tax confusion.

Job Work Processing

Raw materials sent to subcontractors are tracked digitally to ensure quantity reconciliation upon return.

Replacement Under Warranty

Defective items replaced free of cost still require documentation. An e invoice for delivery challan provides proof that the dispatch is non-taxable.

Exhibition or Trade Show

Temporary movement of display goods is verified using registered documentation.

Each scenario demonstrates how the e invoice for delivery challan protects businesses during inspections and audits.

Pros and Cons of Using Electronic Delivery Challans

| Pros | Cons |

|---|---|

| Legal compliance | Initial learning curve |

| Faster inspections | Software costs |

| Reduced paperwork | Internet dependency |

| Audit trail | Portal downtime risk |

| Fraud prevention | Setup configuration required |

Despite minor setup challenges, an e invoice for delivery challan offers long-term efficiency and risk reduction.

Record Keeping and Audit Readiness

Authorities often request historical records during audits. A digitally stored e invoice for delivery challan simplifies retrieval and verification.

Best practices include:

- Store PDFs and JSON files

- Maintain backup copies

- Reconcile monthly reports

- Track cancellations

- Match dispatch with returns

Electronic records reduce audit preparation time and prevent missing documentation penalties. According to compliance standards, structured digital storage improves transparency and speeds tax assessments.

Future of E Invoicing and Digital Compliance

Tax administrations globally are shifting toward real-time reporting. The e invoice for delivery challan is part of this broader digital ecosystem that includes automated reconciliation, analytics, and fraud detection.

Future improvements may include:

- Instant cross-border validation

- AI-based anomaly detection

- Blockchain audit trails

- Direct ERP-to-authority integration

Businesses that adopt the e invoice for delivery challan early align themselves with upcoming regulatory frameworks and avoid last-minute transitions.

Summary

Process: Generate → Upload → IRN → Print

Best method: ERP integration for automation

Key checks: HSN, IRN, transporter details

Main benefit: Faster inspections and fewer penalties

Recommendation: Maintain digital records for audits

Conclusion

An e invoice for delivery challan is no longer optional for compliant goods movement. It provides legal validation, centralized tracking, and real-time reporting that protects businesses from penalties and delays. By following proper generation steps, using reliable software, and maintaining accurate records, organizations ensure seamless logistics and full regulatory compliance.

Frequently Asked Questions (FAQs)

Is an e invoice mandatory for a delivery challan?

Yes. For registered businesses crossing the prescribed turnover threshold, generating an e invoice for delivery challan is mandatory before transporting goods without sale. Authorities may treat unregistered movement as non-compliant and impose penalties.

When should a delivery challan be used instead of a tax invoice?

A delivery challan is used when goods are moved without ownership transfer, such as job work, branch transfer, or exhibitions. In such cases, an e invoice for delivery challan validates the movement legally without charging tax.

What is an IRN in an e invoice?

IRN (Invoice Reference Number) is a unique system-generated code issued by the portal after validation. It confirms that the e invoice for delivery challan is officially registered and verifiable through QR scanning.

Is an E Way Bill required along with the challan?

In most interstate or high-value shipments, an E Way Bill is required. Many systems automatically link it with the e invoice for delivery challan to ensure smooth transport and compliance checks.

What happens if the e invoice is not generated before dispatch?

Transporting goods without a valid e invoice for delivery challan may lead to detention, fines, or seizure. Tax authorities can also impose additional penalties for non-reporting.

Can an e invoice for delivery challan be cancelled or modified?

Yes. Portals typically allow cancellation within a specified time window (for example, 24 hours). After that, adjustments must be made using new documents or credit/debit notes.

Which software can generate an e invoice automatically?

ERP and accounting tools such as Tally, SAP, Zoho Books, and QuickBooks support automated e invoice for delivery challan generation through direct API integration with tax portals.

References

- GST E-Invoice System – Invoice Registration Portal (IRP)

https://einvoice1.gst.gov.in - Federal Board of Revenue (FBR) Digital Invoicing Guidelines

https://fbr.gov.pk - GST Law & Rules – Official Portal

https://www.gst.gov.in - OECD Digital Tax Administration & E-Invoicing Standards

https://www.oecd.org/tax/ - SAP E-Invoicing Compliance Documentation

https://help.sap.com - Tally Prime E-Invoice Guide

https://tallysolutions.com